Business Accounting & Tax Preparation

1585 W Wetmore Road, Tucson, AZ 85705

Mailing Address: P O Box 35743, Tucson, AZ 85740

Phone: 520-292-9773 Fax: 520-292-9878

Accounting By Design, Inc.

Long Term Care Insurance

Long Term Care Insurance is another item that is categorized under Medical Expenses. It is deductible as follows: Age 40 & under $450.00; 41- 50 $850.00; 51-60 $1,690.00; 61-70 $4,510.00 and age 71 and over $5,640. Per diem payments under a qualified long term care contract to a chronically ill individual up to $400 per day is tax-free.Contribution Limitations for Retirement Savings Plans

Contribution Limitations for 2023 - based on the requirements of your plan Traditonal and Roth IRA’s - $6,500.00 - if you are 50 or older $7,500 SEP IRA Employee - 25% of wages up to $66,000 SEP IRA Self-Employed - 25% of net self-employment income after deduction for on-half of SE tax up to $66,000 Simple IRA - Under age 50 - elective deferrals up to $13,500. Age 50 and over - elective deferrals up to $16,500 401(k) Plans - Under age 50 - elective deferrals up to $22,500. Age 50 and older - elective deferrals up to $30,000 403(b) Plans - Under age 50 - elective deferrals up to $22,500. Age 50 and older - elective deferrals up to $30,000Capital Gain & Qualified Dividend Tax Rates

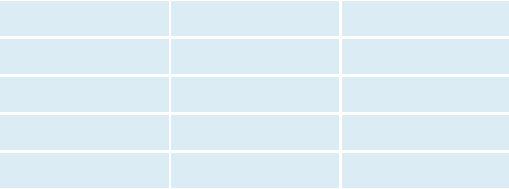

Long Term Capital Gain & Qualified Dividend Rates

0%

15%

20%

Single

$0 - $48,350

$48,351 - $533,400

Over $533,400

MFJ/QW

$0 - $96,700

$96,701 - $600,500

Over $600,500

MFS

$0 - $48,350

$48,351 - $300,000

Over $300,00

HOH

$0 - $64,750

$64,751 - $566,700

Over $566,700

Estates & Trusts

$0 - $3,250

$3,251 - $15,900

Over $15,900

These rates are applicable to taxable income. Long term holding period is greater than a year and qualified dividends holding period is

more than 60 days. Short Term - 10% - 37% and Ordinary Dividend income 12% - 32%

Other Investments

Maximum Tax Rate

Holding Period

Collectibles

28%

More than 1 year

Short-Term CG

37%

Less than 1 year

Unrecaptured Sec 1250 Gain

25%

More than 1 year

Ordinary Dividends

37%

More than 1 year

Taxable portion on qualified

small business stock

28%

More than 1 year

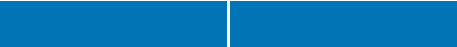

Net Investment Income Tax (NIIT)

3.8% additional tax on investment income if Modified Adjusted Gross Income above threshold amount.

Filing Status

Single, HOH

MFJ, QW

MFS

Threshold Amount

$200,000

$250,000

$125,000